Invest in visible results

Riga’s New CBD: planned to open in 2026

About Preses Nama Kvartāls

A new business district reshaping Riga’s left bank

Preses Nama Kvartāls is a modern, mixed-use urban development rising in the heart of Pārdaugava. Built around the historic former Press House building, the project combines Class A office spaces, retail and public infrastructure. With a focus on sustainability, smart design, and community value, the quarter is set to become Riga’s new business and innovation hub—connecting people, ideas, and opportunities in one dynamic location.

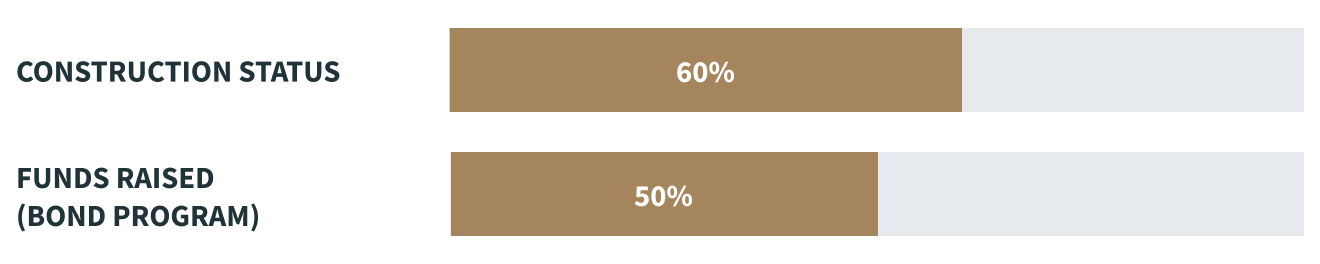

Development progress

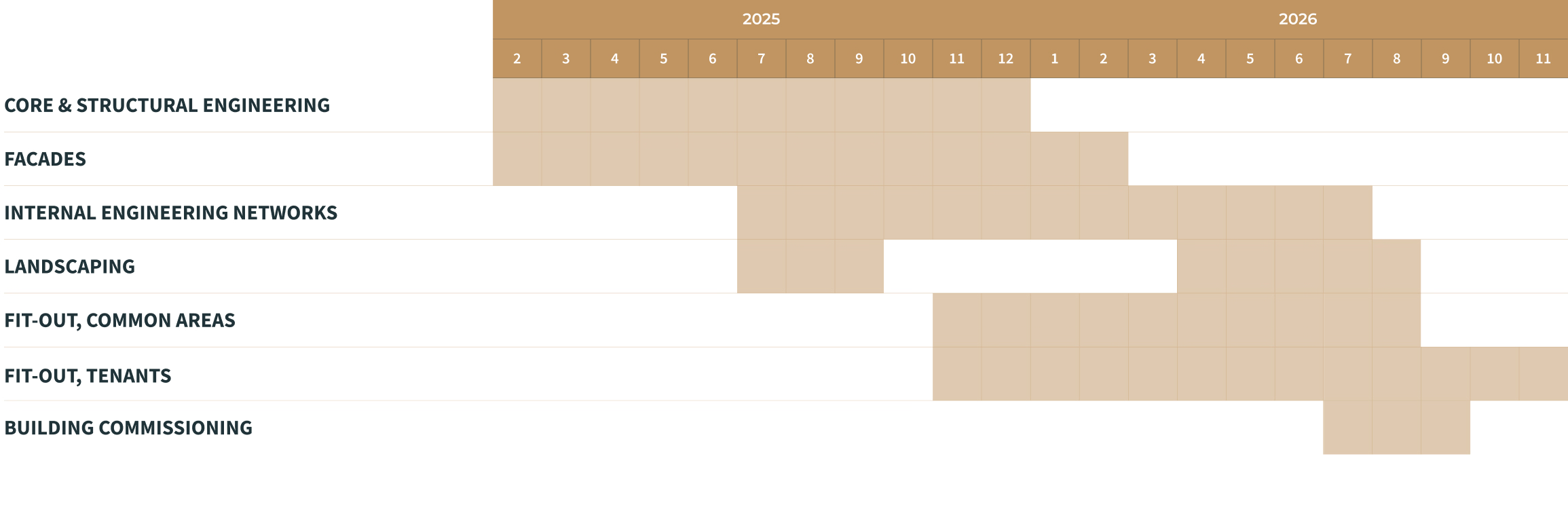

Construction schedule

About the bonds

Invest in bonds with an annual interest rate of 10%. Funds raised from the bond issue will be used to advance the construction and fit-out of the landmark Preses Nama Kvartāls office building and support working capital—ensuring smooth progress of the development.

Key details of the ninth tranche

1 028,0542 €

Issue price

9.5%

Yield

June 2027

Maturity date

Semi-annually

Cupon payment frequency

1 028,0542 €

Minimum investment

General information

Calendar

Subscription period

2026 February 9 – February 20

Issue date

2026 February 24

Maturity date

June 4, 2027

Investor Security Through Collateral

Why invest?

Real, tangible asset

Large-scale, income-generating development in a central location with long-term value.

Advanced project stage

With the main construction phase nearing completion, execution and timeline risks are significantly reduced, offering greater predictability for investors.

Substantial participation by manager

Lords LB Asset Management and related parties have invested €10 million of their own capital, demonstrating long-term commitment and strong alignment with investors.

Part of an established portfolio

Developed by Lords LB Asset Management, a leading Baltic real estate and infrastructure investment manager.

Direct control over execution

Construction is managed in-house, ensuring tighter cost and timeline oversight.

Verified market demand

99% tenant retention in 2024; pre-leasing activity started ahead of formal outreach.

Transparent governance

Structured delivery model, experienced leadership, and clear investor communication support long-term stability.

How to invest

"Investors can purchase the bonds through their bank by searching for PN Project bonds in the investment section of their internet bank or by contacting their bank’s client manager directly.

Detailed information about investing through the largest Baltic banks is available below.

Citadele

Step 1

Log in to your Citadele online banking account.

Step 2

Navigate to the “Investment” section.

Step 3

In the “Orders” section, under “Create New” in the Securities section, select “Order for bond purchase/sale.”

Step 4

Enter the bond offering name ““AS PN Project”” and review the terms.

Step 5

Fill in the online application by completing the mandatory fields marked with an asterisk (*) and submit your application. In the “Information for the bank” field, you can specify: “AS PN Project” public bond offering.

Step 6

Await confirmation from Citadele.

Luminor

Please contact your Client Manager, who will assist you with placing the subscription order via the bank’s online banking system

SEB

Step 1

Log in to your SEB online banking account.

Step 2

Select the “Investment” section, then go to the “Bonds” subsection.

Step 3

Type “AS PN Project” in the search field.

Step 4

Click the “Buy” button and fill in the subscription form by indicating the number of bonds you would like to purchase and the price (100%).

Step 5

Review and submit your application, and follow the instructions provided.

Swedbank

Step 1

Log in to your account using your Swedbank online banking credentials.

Step 2

Navigate to the “Investment” section and select “Corporate Actions, Offers.”

Step 3

From the dropdown menu of currently available public offers, select the bond you’re interested in.

Step 4

Fill in the subscription form by indicating the number of bonds you would like to purchase.

Step 5

Review and submit the form, and wait for confirmation from the bank.

Step 6

Complete any additional steps as instructed by Swedbank.

Signet

For existing clients: Contact your Banker or the Signet Markets team at +371 67 081 069.

For potential new clients: Please contact a Signet Client Relationship Manager at +371 2 9249330.

BluOrBank

If you already have an investment account with the bank, you can place your order using voice brokerage services by calling +371 67 034 222, or through the online banking system

Artea

Step 1

Login to your internet banking account

Step 2

Navigate to securities trading platform

Step 3

The bond offering can be found in the tab “Bonds”. Press on the bond being offered and enter the investment amount. Amount being invested must be accrued in client’s investment account

Detailed information on digital onboarding can be found here

LHV

Step 1

Visit: https://investor.lhv.ee/en/offering and review details of the current bond offering.

Step 2

Log in to LHV Internet Bank. Use your credentials to access your account.

Step 3

Navigate to the Investments or Bonds section.

Step 4

Fill In the subscription order.

Step 5

Confirm and submit the order.

Tenants

Designed for Ambitious Tenants

Preses Nams Quarter is built for modern businesses — from shared service centers and tech firms to financial institutions and coworking operators. Its flexible layouts, spacious floorplates (up to 170 people per floor), and high visibility from Krišjāņa Valdemāra Street and Vanšu Bridge make it ideal for companies seeking both functionality and recognition.

Panoramic views of the Daugava River and Riga’s skyline

Excellent infrastructure

Flexible office planning options

Sustainability certificate BREEAM Excellent

Location

Balasta dambis 2, Rīga, LV-1048

View from project site

About the Lords LB

- 20

- Funds ranging by strategy, sector and style

- 1B+ €

- Assets Under Management

- 60+

- Dedicated investment professionals

Management team

Management board

Supervisory board

Povilas Urbonavičius

Chairman & Fund Manager

Mr Povilas Urbonavičius is an experienced real estate professional with a demonstrated history of working in real estate development. Mr Urbonavičius is skilled in real estate, business development, management and business planning. His prior experience includes leadership positions in Darnu Group and Omberg Group, key players of Lithuanian real estate development field. Povilas Urbonavičius holds a bachelor’s degree in civil engineering.

Trust signals

Supported and certified by

Videos

Investor Webinar (ENG)

Site progress update (14.05.2025.)

FAQ

What is Preses Nama Kvartāls?

It is a large-scale, mixed-use business quarter under development in Pārdaugava, Riga. The first Class A+ office building is already under construction and scheduled for completion in 2026.

What is the maturity date of the bonds?

The bonds mature in 2027. Detailed terms are provided in the offering documents.

Why invest in this project?

This is a rare opportunity to invest in a tangible, high-quality development at a mature stage. The project is already halfway built and highly visible in Riga’s skyline, with strong interest from future tenants.

Who is behind the project?

Preses Nama Kvartāls is developed by AS PN Project, a subsidiary of Lords LB Special Fund V, managed by Lords LB Asset Management — one of the leading real estate investment managers in the Baltics with a strong track record, including previous bond issuances.

How will the funds be used?

The proceeds from the bond issue will be used to finance ongoing construction works and cover associated development costs of the Preses Nama Kvartāls project.

How is investor security ensured?

The bond structure includes specific investor protections and collateral. Full details are available in the prospectus and offering documentation.

What are the risks?

As with any investment, bonds carry risks, including construction, market, and credit risks. Investors should review the risk factors outlined in the offering documents.

Who can invest in these bonds?

The bond offer is open to both institutional and retail investors in the Baltic region, subject to local regulations.

Prospectus

Financial Statements

Contacts

Rasa Bartusevičienė

Mobile

E-mail

Dana Česūnė

Mobile

Phone

E-mail